Solar Installation Cost Analysis: Your Guide

Solar Installation Cost Analysis: Your Guide to the Philippine Solar Market

Executive Summary

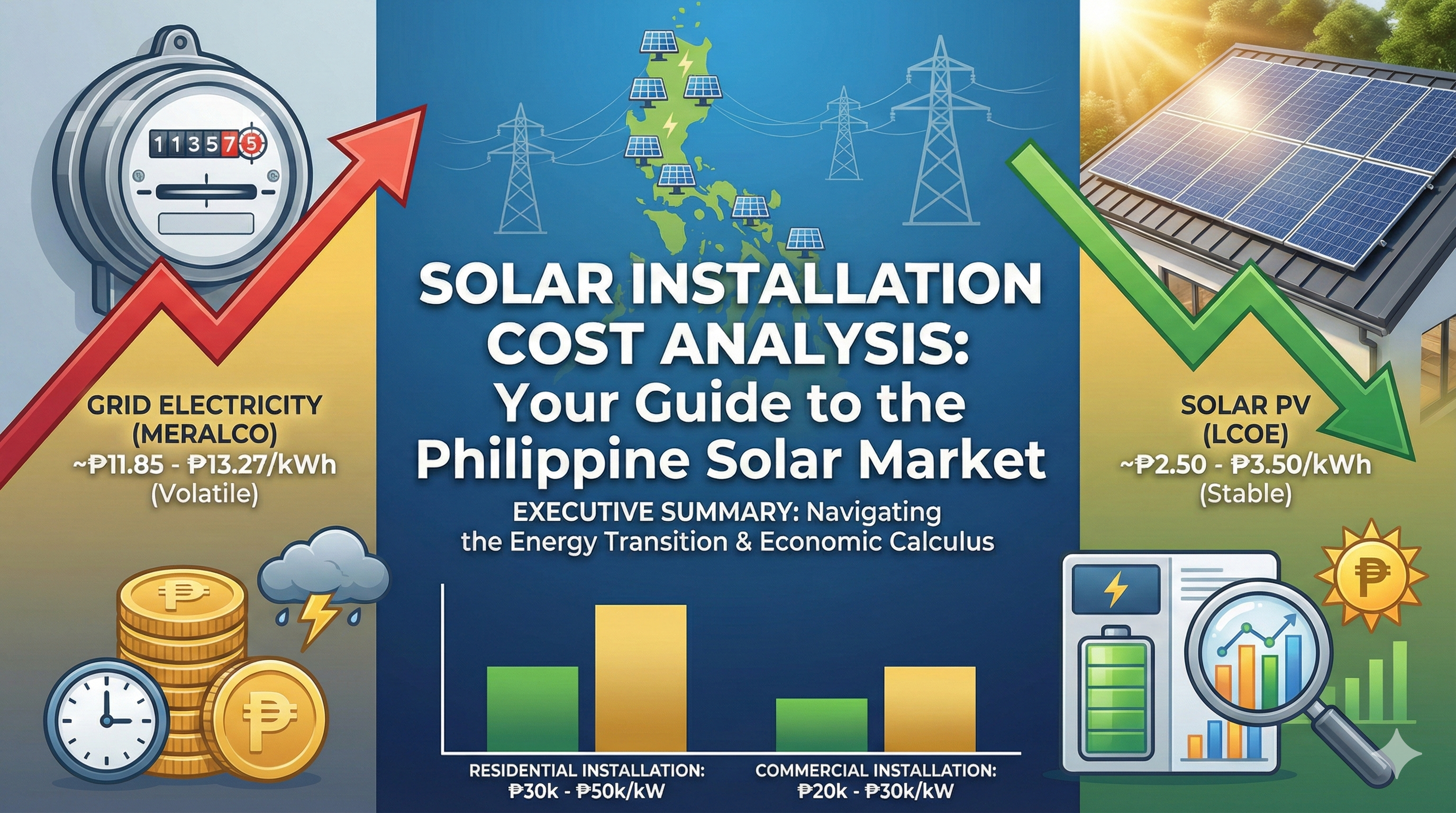

The Philippine energy sector is currently navigating a period of unprecedented transformation, characterized by the convergence of technological maturity in renewable energy systems and a volatile fossil-fuel-dependent grid. As of late 2024 and moving into 2025, the Philippines contends with some of the highest electricity rates in the Asia-Pacific region, a reality that has fundamentally altered the economic calculus for solar photovoltaic (PV) adoption. No longer merely an ecological statement, solar energy has emerged as a critical financial hedge for residential households and a strategic operational imperative for commercial enterprises.

The impetus for this report stems from the urgent need to demystify the cost structures, market dynamics, and return on investment (ROI) potential of solar energy in the Philippine context. With the Manila Electric Company (Meralco) reporting residential rates oscillating between PHP 11.85 and PHP 13.27 per kilowatt-hour (kWh) driven by fluctuating generation charges and currency depreciation 1, the "cost of inaction"—remaining solely dependent on the grid—has reached unsustainable levels. In stark contrast, the Levelized Cost of Electricity (LCOE) for residential solar systems has plummeted to a range of PHP 2.50 to PHP 3.50 per kWh 4, creating a massive arbitrage opportunity.

This comprehensive guide provides an exhaustive analysis of the Philippine solar market. It dissects installation costs, which for residential systems are stabilizing between PHP 30,000 and PHP 50,000 per kilowatt (kW), and for commercial systems are achieving economies of scale at PHP 20,000 to PHP 30,000 per kW.4 Furthermore, it explores the nuanced regulatory landscape of Net Metering under the oversight of the Energy Regulatory Commission (ERC), the proliferation of green financing instruments from major banks like BPI, BDO, and Security Bank, and the technical considerations necessitated by the country’s unique tropical and typhoon-prone climate.

By synthesizing data on hardware pricing, labor dynamics, permitting bureaucracies, and financial modeling, this report aims to serve as the definitive reference for stakeholders navigating the transition to renewable energy in the Philippines.

1. The Macro-Economic Landscape of Philippine Energy

To fully appreciate the value proposition of solar energy, one must first understand the broader economic and infrastructural context of the Philippine power sector. The country’s electricity prices are structurally high due to a combination of geographical fragmentation, heavy reliance on imported fossil fuels, and specific market mechanisms.

1.1 Structural Drivers of High Electricity Costs

The Philippines lacks significant domestic fossil fuel reserves, necessitating the importation of coal and oil to fuel its baseload power plants. This exposure links the monthly electricity bill of every Filipino household directly to global commodity markets and foreign exchange rates. When the Philippine Peso depreciates against the US Dollar—as seen in late 2024—the cost of imported fuel rises, a cost that is automatically passed through to consumers via the Generation Charge.2

Furthermore, the Wholesale Electricity Spot Market (WESM) dictates the price of electricity traded between generators and distributors. During periods of high demand or when baseload plants undergo unscheduled outages—a frequent occurrence in the Luzon grid—WESM prices spike. In August 2025, for instance, Meralco rates surged to PHP 13.2703 per kWh, largely driven by these generation charge adjustments and the weakening Peso.2 This volatility makes financial planning difficult for businesses and households alike, rendering the fixed-cost nature of solar energy particularly attractive.

1.2 The "Cost of Inaction"

The most compelling argument for solar adoption is the avoided cost of grid electricity. An analysis of the current rate structure reveals that the generation charge—the portion of the bill that pays for the actual production of electricity—often comprises nearly 60% of the total bill. The remaining components include transmission charges (NGCP), distribution charges (Meralco/DU), system loss charges, and taxes.

When a consumer installs a grid-tied solar system, they are effectively pre-paying for 25 years of electricity generation. With current installation costs, the effective price per kWh of solar energy is approximately PHP 3.00. Comparing this to the grid rate of PHP 12.00+ reveals a savings of roughly PHP 9.00 for every kilowatt-hour consumed. Over the 25-year lifespan of a system, this accumulates into millions of pesos in savings, a concept we define as the "Cost of Inaction"—the money lost by continuing to rent electricity rather than owning the means of production.

1.3 Solar Irradiance and Technical Potential

The Philippines benefits from an enviable solar resource. Located near the equator, the archipelago receives a high level of solar irradiance, averaging between 4.5 to 5.5 kWh per square meter per day.6 This technical potential translates to higher energy yields per watt of installed capacity compared to temperate regions. A 1 kWp system in Manila will produce significantly more energy annually than the same system in Berlin or London, accelerating the payback period and enhancing the economic viability of projects even without direct government subsidies like Feed-in Tariffs (which have largely been phased out for new small-scale entrants).

2. Residential Solar Cost Analysis (2024-2025)

The residential solar market in the Philippines has matured significantly, moving from a niche hobbyist pursuit to a standardized home improvement product. Costs have stabilized, and the supply chain has robustly recovered from post-pandemic disruptions. However, pricing varies significantly based on the system architecture: Grid-Tie, Hybrid, or Off-Grid.

2.1 Grid-Tie System Economics

The Grid-Tie system remains the most popular and cost-effective solution for residents in urban centers like Metro Manila, Cebu, and Davao, where the grid is relatively stable. These systems synchronize with the utility grid, offsetting consumption in real-time and exporting excess power. Crucially, they do not function during power outages due to "anti-islanding" safety protocols.

Cost Breakdown by System Capacity:

System Size (kWp) | Target Monthly Bill (PHP) | Estimated Cost Range (PHP) | Price per Watt (PHP) | Component Context |

1.5 kW - 1.6 kW | 3,000 - 5,000 | 108,000 - 150,000 | ~67,500 - 93,000 | Entry-level systems using micro-inverters or small string inverters. Higher per-watt cost due to fixed labor/permitting fees. 8 |

3.0 kW - 3.2 kW | 8,000 - 12,000 | 183,000 - 220,000 | ~61,000 - 68,000 | Suitable for homes with 1-2 air conditioning units. The "sweet spot" for small families. 9 |

5.0 kW - 5.6 kW | 15,000 - 20,000 | 270,000 - 365,000 | ~48,000 - 65,000 | Standard executive home size. Maximizes single-phase inverter capacity. 9 |

10 kW+ | 30,000+ | 500,000 - 800,000 | ~50,000 - 80,000 | Large luxury homes. Often requires three-phase electrical upgrades. 12 |

Analysis of Cost Drivers:

Hardware Commoditization: The cost of solar panels has dropped to a point where they often constitute less than 40% of the total project cost. In 2025, residential solar panels are priced between PHP 30,000 and PHP 40,000 per kW.4

Labor and "Soft Costs": As hardware gets cheaper, the proportion of cost attributed to labor, engineering, and permitting increases. Installing a 1.6 kW system takes nearly the same administrative effort (permitting, logistics) as a 5 kW system, explaining the higher price-per-watt for smaller installations.

Premium vs. Standard: The upper end of the price range reflects the use of premium European or American inverters (e.g., Fronius, SMA, Enphase) and high-efficiency N-Type panels (e.g., SunPower, REC). The lower end typically utilizes Tier-1 Chinese brands (e.g., Growatt, Solis, Huawei, Jinko, Longi), which offer excellent performance-to-value ratios and dominate the Philippine market.13

2.2 Hybrid System Economics: The Price of Independence

For homeowners in provinces with frequent brownouts (e.g., Mindoro, Palawan) or those seeking resilience against grid failures, Hybrid systems are the standard. These systems incorporate a battery bank and a specialized hybrid inverter (often Deye or GoodWe) to store energy for use at night or during outages.

The "Battery Premium":

Adding energy storage fundamentally changes the economic equation. It increases the upfront capital expenditure (CAPEX) significantly while extending the ROI period, as batteries add cost without generating new energy—they merely time-shift it.

System Pricing: A 5kW Hybrid System with a standard 5kWh - 10kWh battery bank typically starts at PHP 460,000 and can exceed PHP 900,000 depending on battery capacity.15 This is nearly double the cost of a comparable grid-tie system.

Battery Technology and Cost:

Lithium Iron Phosphate (LiFePO4): This chemistry has replaced Lead-Acid as the industry standard due to its safety, depth of discharge (80-90%), and cycle life (6000+ cycles).

Unit Cost: A 48V 100Ah LiFePO4 battery (providing ~5kWh of storage) retails between PHP 68,000 and PHP 85,000.16

Forecast: Storage costs are predicted to decrease by 10-15% in 2025, which may lower the barrier to entry.4

Operational Value:

While the ROI is slower (6-9 years vs 3-5 years for grid-tie), the value of hybrid systems lies in business continuity and lifestyle preservation. For a home-based worker, the cost of a brownout is lost income. A hybrid system eliminates this risk, serving as a silent, fuel-free generator.

2.3 Off-Grid Considerations

True off-grid systems—disconnecting entirely from Meralco—are generally not recommended for urban residential applications. To go off-grid reliably, one must "oversize" the solar array and battery bank to account for 3-5 days of continuous rain (autonomy). This oversizing can triple the cost compared to a grid-tied system. For example, a reliable off-grid system for a medium house could cost upwards of PHP 1.2 Million.8 In the Philippine context, the grid connection serves as an infinite, low-maintenance backup battery, making grid-tied or hybrid architectures far more economical.

3. Commercial & Industrial (C&I) Market Insights

The Commercial and Industrial (C&I) sector operates on a different scale and set of incentives. For factories, malls, and cold storage facilities, electricity is often a top-three operational expense. Solar power offers a way to flatten this cost curve and improve bottom-line profitability.

3.1 Economies of Scale and Pricing

Commercial installations benefit from massive economies of scale. Procurement of panels is done by the container load, and installation on large, unobstructed metal roofs is highly efficient.

Price Range: Commercial turnkey costs have dropped to PHP 20,000 - PHP 30,000 per kW.5

Inverter Efficiency: Commercial projects utilize high-capacity string inverters (50kW, 100kW), which have a much lower cost-per-watt than residential units.

Mounting Simplicity: Industrial roofs typically use "Klip-Lok" or standing seam clamps which do not require penetrating the roof, speeding up installation and reducing leak risks.

3.2 Case Studies in ROI

Real-world performance data validates the financial thesis for C&I solar.

Automotive Dealerships: Data from dealerships in Batangas and Camarines Sur (approx. 100kWp systems costing PHP 7-8 Million) showed annual savings of over PHP 1.2 Million. This yielded a verified ROI of roughly 5.7 to 6.2 years.19 With electricity rates having risen since that data point, current payback periods for similar projects are likely closer to 4-5 years.

Manufacturing: MSpectrum’s project for Alphatech Development Corporation highlights the trend of manufacturers using solar not just for savings but to decarbonize their supply chain, a requirement increasingly imposed by global export partners.20

3.3 Financing Models: CAPEX vs. OPEX

Businesses in the Philippines have two primary ways to adopt solar:

CAPEX Model (Direct Ownership): The business uses its own capital or a bank loan to buy the system. This offers the highest long-term savings but impacts liquidity.

OPEX Model (PPA / Lease): A third-party provider (e.g., Buskowitz Energy, MSpectrum) installs the system at zero upfront cost.

Power Purchase Agreement (PPA): The provider sells the generated electricity to the business at a rate lower than the grid (e.g., PHP 8.00 vs PHP 12.00).

Solar Lease: The business pays a fixed monthly rent for the equipment.

Strategic Fit: The PPA model is favored by companies that prefer to keep debt off their balance sheet and retain capital for core business expansion. Buskowitz Energy, for instance, has secured extensive funding to deploy this model across the Philippines.21

4. Technical Analysis: Components and Quality Standards

The longevity of a solar investment—projected at 25 years—depends entirely on the quality of the components selected. The Philippine market is flooded with a wide range of equipment, from premium Tier-1 brands to generic, uncertified hardware.

4.1 Photovoltaic Modules (Solar Panels)

Technology: The market has shifted from Polycrystalline to Monocrystalline PERC (Passivated Emitter and Rear Cell) and is rapidly adopting N-Type TOPCon (Tunnel Oxide Passivated Contact) technology. N-Type panels are particularly suited for the Philippine climate as they have a lower temperature coefficient, meaning they lose less efficiency in high heat compared to older technologies.

Pricing:

Standard 450W-550W panels: PHP 7,000 - PHP 9,000 per panel.18

Premium High-Efficiency panels: PHP 12,000+ per panel.

Durability: Panels must be IEC 61215 certified to withstand environmental stress. In the Philippines, resistance to salt mist corrosion (for coastal areas) and Potential Induced Degradation (PID) is critical.

4.2 Inverters: The System Brain

The inverter converts DC power from panels to AC power for the home. It is the most complex component and the most likely point of failure.

String Inverters: Brands like Huawei, Growatt, and Solis dominate the grid-tie market. They are robust, fan-less (passive cooling), and cost-effective. A 5kW unit typically costs PHP 35,000 - PHP 50,000.

Microinverters: Brands like Enphase offer module-level optimization, safer low-voltage DC, and better performance in shaded conditions. However, they cost significantly more (PHP 100,000 - PHP 300,000 for a system), pushing the ROI out by several years.23

Hybrid Inverters: Deye has captured significant market share in the Philippines due to its "diesel generator input" feature, allowing it to seamlessly integrate solar, battery, and a backup gen-set—a perfect trifecta for off-grid or unstable grid areas.13

4.3 Mounting Structures and Wind Load

The Philippines sits in the typhoon belt. The structural integrity of the mounting system is non-negotiable.

Materials: Anodized Aluminum 6005-T5 is the standard for rails and clamps to prevent corrosion.

Wind Load Ratings: Systems must be engineered to withstand wind speeds of 200 to 250 kph. This requires specific rail thicknesses, clamp spacing (often every 0.8 meters instead of 1.2 meters), and screw penetration depths.

Cost: A 2.4-meter rail costs between PHP 269 and PHP 600.24 Skimping here to save a few thousand pesos puts the entire multimillion-peso asset at risk.

5. Regulatory Landscape: Net Metering and Compliance

Net Metering is the policy mechanism that makes grid-tied solar financially viable for residential users. It allows "prosumers" to export excess electricity to the grid in exchange for bill credits.

5.1 The Net Metering Mechanism (RA 9513)

Under the Renewable Energy Act of 2008, distribution utilities (DUs) like Meralco are mandated to enter into Net Metering agreements with qualified end-users (QE) for systems up to 100 kW.

Bi-Directional Meter: The DU replaces the standard meter with one that records both import (consumption) and export (generation).

Bill Credits: Excess energy is not paid in cash but credited to the bill. These credits can offset the generation charge, transmission charge, system loss charge, and other subsidies on the import side.

5.2 The Economic Reality of "Blended Rates"

A critical nuance often misunderstood by consumers is the export rate. Meralco does not buy back power at the retail rate (e.g., PHP 12.00).

Import Rate: ~PHP 12.00/kWh (Retail rate).

Export Rate: ~PHP 7.90 - 8.00/kWh (Blended Generation Charge).3

Implication: The DU only credits the generation cost of the power. They do not credit the distribution or transmission costs, as the prosumer does not own the grid.

Strategy: Because exporting pays less than the cost of importing, self-consumption is always more profitable. Solar systems should be sized to cover the daytime "baseload" (refrigerators, pumps, daytime AC) to minimize exports.

5.3 Recent Regulatory Improvements (2025)

The Energy Regulatory Commission (ERC) has recently updated the Net Metering Rules (Resolution No. 15, Series of 2025) to further incentivize adoption:

Credit Banking: Net Metering credits typically had a 1-year expiration or were difficult to cash out. New rules allow for the indefinite banking and rollover of credits, meaning excess production during the sunny summer months can offset bills during the rainy season.25

Streamlined Permitting: The ERC has mandated a reduction in the "red tape" DUs can impose, removing the requirement for a separate Renewable Energy Certificate (REC) meter for small systems, which reduces installation costs.26

6. Financial Analysis and Return on Investment (ROI)

The financial case for solar in the Philippines is among the strongest globally due to the high baseline cost of electricity.

6.1 ROI Modeling

Scenario: A standard urban household installing a 5kW Grid-Tie System.

Total Investment: PHP 300,000.

Daily Production: 20 kWh (based on 4 peak sun hours).

Monthly Savings: ~PHP 8,000 (Assuming 80% self-consumption at PHP 12/kWh and 20% export at PHP 8/kWh).

Annual Savings: PHP 96,000.

Simple Payback Period: 3.1 Years.

25-Year Cumulative Savings: Over PHP 2.4 Million.11

Internal Rate of Return (IRR): >30%.

This payback period is exceptionally fast. In comparison, solar payback in the US or Europe often ranges from 7 to 9 years. The Philippine market offers a unique combination of high irradiance and high utility rates that accelerates capital recovery.

6.2 Financing Options (2024-2025)

Recognizing this potential, the Philippine banking sector has launched specialized "Green Energy" loan products.

Comparative Analysis of Solar Financing Products:

Institution | Product Name | Interest Rate | Terms | Key Features |

BPI | Green Solutions / Solar Mortgage | 7.00% (Fixed 7 Years) | Up to 7 Years | Top-up on existing housing loan; lower rates than personal loans. 27 |

Security Bank | Solar Mortgage | 7.75% (1 Year Fixed) | Up to 25 Years | High LTV (90%); ideal for new home builders incorporating solar. 29 |

Pag-IBIG Fund | Home Improvement Loan | ~6.375% (Standard Housing Rate) | Long Term | Most accessible option; government-backed; caps at PHP 500k for solar. 30 |

BDO | Home Loan (Solar) | Market Rates | Up to 20 Years | Leverages BDO's massive sustainable finance portfolio (>PHP 1 Trillion). 32 |

In-House Financing:

Many EPC providers (e.g., Solaric) also offer 0% interest installment plans via credit cards for 12 to 24 months. While convenient, these plans often apply to the "SRP" (Suggested Retail Price), whereas cash payments might attract significant discounts.

7. Implementation: Permitting, Logistics, and Maintenance

The journey from decision to energization involves navigating physical and bureaucratic challenges.

7.1 The Permitting Process

Connecting a solar system to the grid is a regulated activity. The "soft costs" and time associated with this can be substantial.

Barangay Clearance: The first step, usually simple.

Building Permit: Required by the Local Government Unit (LGU). The fee is calculated based on the "cost of construction" or area. For a residential system, this can range from PHP 15,000 to PHP 25,000 depending on the municipality.34

Electrical Permit: Signed and sealed by a Professional Electrical Engineer (PEE).

Distribution Impact Study (DIS): A technical study by Meralco to ensure the local transformer can handle the exported load. For standard residential systems, the DIS fee is often waived or minimal.36

Yellow Card (CFEI): The Certificate of Final Electrical Inspection issued by the LGU is the "golden ticket" required by Meralco to install the Net Metering meter.

Timeline: The entire process typically takes 3 to 6 months, though recent ERC rules aim to shorten this.37

7.2 Maintenance and Operations (O&M)

Solar PV systems are low-maintenance, but environmental factors in the Philippines require attention.

Cleaning: Dust, bird droppings, and urban pollution can reduce system output by 5-15%. In the Philippines, panels should be cleaned every 3-6 months. Professional cleaning services cost averages PHP 2,500 per visit.38

Preventive Maintenance: Annual checks on inverter error logs, MC4 connector tightness (to prevent thermal hotspots), and mounting clamp torque are recommended.

Commercial O&M: For C&I clients, companies like Buskowitz and MSpectrum offer full O&M contracts with performance guarantees, ensuring the system hits its generation targets.39

8. Future Outlook and Emerging Trends

The Philippine solar market is not static. Several trends will shape the landscape through 2030.

8.1 Floating Solar

With land scarcity in Luzon, developers are looking to water. The Laguna Lake Development Authority (LLDA) is piloting massive floating solar farms. These systems benefit from natural cooling (water) which boosts panel efficiency, though anchoring them against typhoons remains an engineering challenge.

8.2 Virtual Power Plants (VPP)

As residential battery adoption grows, the concept of a Virtual Power Plant is emerging. This would allow a utility to aggregate thousands of home batteries to discharge power into the grid during peak demand, effectively acting as a decentralized power plant. While regulatory frameworks for this are still in infancy in the Philippines, the hardware (hybrid inverters) is already being deployed.

8.3 The Terra Solar Project

The Terra Solar project, backed by prime movers like Prime Infra and financed by banks including BDO, is set to be the world's largest solar-plus-storage facility. This utility-scale development signals deep institutional confidence in solar technology and will likely drive further supply chain efficiencies that will trickle down to the residential market.40

8.4 Price Forecasts

Panels: Continued gradual decline in price.

Batteries: Significant price drops expected (10-15% annually).

Labor: Likely to increase as the demand for skilled solar technicians outstrips supply.

Net Result: Total system costs will likely remain stable or decrease slightly, but the value (capacity per peso) will increase significantly as panels become more powerful and batteries more affordable.

Conclusion

In the Philippine context, solar energy has graduated from an alternative lifestyle choice to a fundamental financial instrument. The convergence of high grid rates, plummeting hardware costs, and a supportive financing environment has created a market where the ROI is undeniable.

For the residential homeowner, a grid-tied system offers a tax-free yield of over 30%—far outperforming stocks or bonds. For the commercial entity, it is a strategic necessity to stabilize operational costs and meet sustainability goals. While bureaucratic hurdles in permitting persist, the long-term trajectory is clear: the Philippines is moving toward a distributed, solar-powered future. The question for consumers in 2025 is no longer "Why should I install solar?" but rather "Can I afford not to?"